Check out these guangzhou trading company images:

Where in the globe is this?

Image by jurvetson

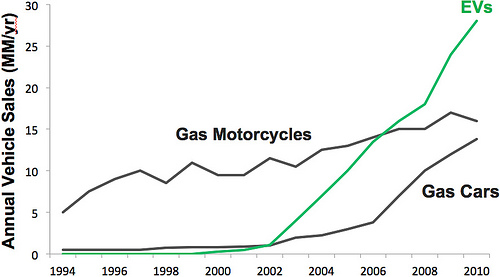

And why did it happen? The EV category is two and four-wheel autos. (jump to answer beneath)

The graph above seemed like a peek into the future, even though it’s a graph of the previous.

Meanwhile, in the U.S., oil expenditures for our automobiles have spiked to billion per day. So we have transferred .five trillion of wealth overseas, mostly to OPEC nations, in just the final five years. And that’s just the direct expense… RMI estimates the indirect financial and military costs as double that — an additional billion per day.

It was on my mind as I just read a couple of exciting new Safe reports on U.S. power security. The very first was Oil and the Trade Deficit:

“In 2011, petroleum products accounted for 58 % of the total U.S. trade deficit—more than double the percentage just a decade earlier.

Continuous and growing U.S. trade deficits cannot be sustained indefinitely as the collective interest payments on the accumulated debt develop faster than income.

Higher and volatile oil rates have pushed the expense of petroleum to levels that would have seemed unimaginable just more than a decade ago. This has contributed to a rapid expansion of the U.S. trade deficit, rendering the nation increasingly dependent on foreign capital inflows and creating up an huge monetary liability to foreign entities. A readjustment of the U.S. trade deficit from present levels is practically certain to be necessary. This procedure could have a serious damaging influence on the U.S. and international economies.

Every single day, the United States consumes as a lot oil as China, Japan, Russia, and Germany combined.

As a outcome, the United States has run an aggregate deficit in petroleum of much more than .5 trillion given that 2007.

Even though all of these options offer you the possibility of lowering U.S. oil use, car electrification has so far shown the greatest guarantee for substantial oil displacement

Importantly, the spectrum of electric-drive automobiles offer you the most significant, commercially-available improvements in automobile power efficiency nowadays.

The nation’s dependence on oil poses a critical and ongoing threat to financial and national safety.”

The second report was The New American Oil Boom:

“Measured in terms of the share of GDP devoted to petroleum spending, the threat of oil dependence is nowadays at its highest level because the early 1980s.

The notion of energy independence is based on a simple idea: that the United States can regain manage of its economy and its national security—at least in part—by ending its reliance on foreign oil. As discussed above, this thought has its roots in decades of American political dialogue generated for the duration of instances of crisis in the international oil market place. Regrettably, this concept is fundamentally misguided and misleading. In fact, the United States has no signifies by which it can turn out to be independent from the global oil market place or foreign nations as long as it is a massive consumer of oil.

The prominence of transportation demand gives oil the majority of its financial significance in the United States. This is simply because it is the sector in which it has confirmed the most hard to deploy substitutes at scale. Substitutes had been most simply deployed in the electric power sector, where petroleum was virtually eliminated as a feedstock in the wake of the 1970s power crises. Residential oil demand for space heating also proved relatively simple to displace.

90 percent of conventional oil reserves are held by national oil businesses whose investment and production choices are far removed from the totally free market place ideal. Merely put, there is no totally free market for oil.

In current months, a quantity of political commentators have suggested that, as the United States produces a lot more oil domestically, it will accomplish sharply reduce rates in considerably the very same way that all-natural gas rates have fallen during the surge in U.S. shale gas production. This merely is not credible. While the United States does have a big degree of autonomy in organic gas pricing, this is since the oil and natural gas markets are vastly various: there is no international market place for gas.

Fuel efficiency is not sufficient on its own. The extended-term aim of power safety policy need to be to break the petroleum’s stranglehold on the transportation sector.

Over the extended term, the United States can accomplish meaningful power safety by transitioning away from liquid fuels in the transportation sector.”

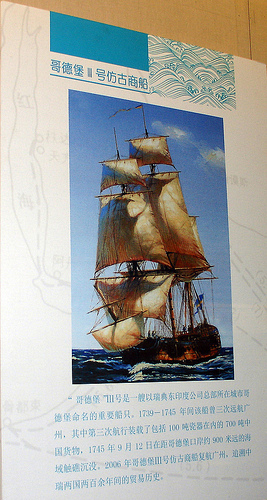

The Götheborg East Indiaman Trading Vessel

Image by drs2biz

The Götheborg East Indiaman was an critical vessel for the Swedish East India Organization. During the period 1739 to 1745, the Götheborg had sailed to Guangzhou 3 instances. On the 3rd trip it was loaded with around one hundred tonnes of Chinese porcelain china, and a further 700 tonnes of assorted Chinese items.

The vessel struck a reef and sank off Gothenburg, Sweden on 12th September, 1745 while approaching its home harbour soon after returning from her third voyage to China. All sailors survived, but the ship was lost.

In 2006, the "New Götheborg" sailed to Guangzhou to commemorate 200 years of trade between China and Sweden.